Return on investment is a big deal for any and all businesses. For many companies, it’s the ultimate measure of a campaign’s success. From big business to small ventures, ROI can be used to see how your investment made money back. By comparing the initial investment to the end profits of the campaign, you can start calculating ROI and boil it down to a simple percentage.

Let’s take a look at how to find that percentage, and how it can be used to figure out exactly what your campaign made for your company.

The ROI Formula

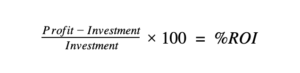

The formula is very simple for calculating ROI:

Since we are looking at the total made from the campaign, we have to start with the campaign as the base. Then we divide the difference between total profit and initial investment by the initial investment. The reason being, we need to find the difference in what we made compared to the investment.

We can’t stop there though, as that number will give us a simple number, so we have to multiply it by 100 to get the percentage gained on the campaign.

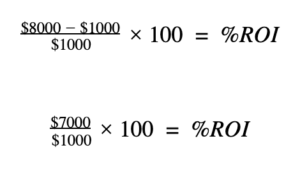

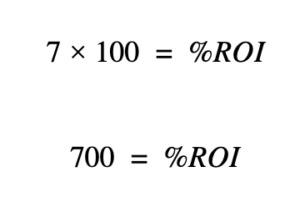

Let’s say you have a campaign with an initial investment of $1000. After everything is said and done, your campaign secures $8000 in profit. Is that a good ROI? At first glance, it will be a yes, but let’s plug it into our equation to make sure.

As you can see from the example, our initial investment turned into a 700% return on investment. That’s extremely good when you are talking about the ROI of the campaign.

So, what happens when the profit numbers aren’t as high? Can we still find a good return on investment? Let’s find out:

Say we take that same investment, but we change it to where the campaign only profited $1500.

Even though the profit numbers seemed quite low compared to the last example, we still turned a 50% return on investment, and that’s really good. Typically, a great return on investment is anything above 15%.

Even at that “low” of a percentage, you’re still in the market to make a lot of money off of a campaign. This is true because as initial investments rise, it becomes harder to get higher return percentages. Think about it, if you initially invest in a campaign with $100,000 and you profit $115,000, that 15% ROI just made you $15,000. That’s a lot of capital to work with and grow with.

Creating Your Categories for Calculating ROI

When you are calculating your return on investment, you want to make sure your numbers are as clear as they can be. That means making sure everything is accounted for on both ends before completing the equation.

Investment

When you are looking to find the number for your investment portion of ROI, you need to make sure everything is accounted for. The obvious parts are the cost of equipment, the venue, and additional expenses throughout the event, but most people forget to add the most important part, labor hours.

Make sure you have everything accounted for that puts you in the red for your event. If you don’t have everything, your numbers won’t be true to the actual ROI of the campaign or event. Try your best to get extremely detailed numbers when you putting this investment number together. The closer that number is to the real deal, the less room for error your ROI equation will have.

Profits

You want to make sure all the profits are put together from the different areas of the profit potential of a campaign or event. Concessions, donations, and sales should all find their way into this number. If you have raffles at an event, make sure the tickets are tallied and added too. Just like the initial investment numbers, you want to make sure this number is as accurate as possible because, like a botched starting number, a botched profit number can be just as impactful to the error potential in your ROI equation.

Calculating ROI Keeps You On Track

The return on investment potential of any campaign or event can help you stay on track. Once you get the hang of using this equation for events that have already happened, you can start to apply it to a prediction equation for future events. You’ll be able to break down the sales numbers needed to mean your initial investment and exceed it.

This is especially true for annual events, as you have historical data to go off. Instead of wandering through the dark in the hopes of making your investment back, you can get an idea of what the numbers really need to look like to make it happen.

If your company has a specified net profit goal, these reports can help you make sure you are meeting them just like you are supposed to. Say your CEO wants you to keep a 30% margin in the company.

Taking our 15% example from before, you wouldn’t quite make it. So, where can you expand or reduce spending to make your profit numbers where they need to be? This equation helps you find the right direction by putting everything involved into simple numbers. Calculating ROI is easier than you think!